Automation Report 2023

An in-depth review of operations using autonomous solutions in every region and sector, including analysis of the factors driving investment decisions

A slowdown in the pace of adoption this year suggests new obstacles such as technological limitations and a skills shortfall are also coming into play.

Miners are still citing increased safety, productivity, and efficiency as the main drivers for take-up of automated equipment in 2022-2023, but a slowdown in the pace of adoption this year suggests new obstacles such as technological limitations and a skills shortfall are also coming into play.

The number of automated vehicles in operation last year, across the assets covered in this report, grew 7.1% to 1380. A rise that pales in comparison to the 34% leap in deployments of automated trucks, loaders and drill units seen in 2021-2022.

No vehicle class was immune to the deceleration in adoption. Despite being a costly and complex automated option, loaders saw the largest percentage growth at 8.7% to 124 units, while truck deployments rose by 7.6% to 1058 units and the number of automated drill rigs in action grew by 3.4% to 196. These classes rose by 42%, 34% and 34%, respectively, in the 2021 report.

The slowdown contrasts with the notable increase in major mining assets covered in this report, which grew by over 20% thanks to the inclusion of high-profile projects such as Mongolia’s vast Oyu Tolgoi copper mine, Gold Fields’ Granny Smith in Western Australia and the Boliden iron ore mine in Sweden.

Opex and optimisation

A driverless 45t dump truck at Seongshin limestone mine has heralded the start of automated mining in South Korea. At Glencore’s Mount Isa copper mine, operators are now able to simultaneously monitor and control up to three active loaders from each operating station – all from the safety of an above-ground remote control room.

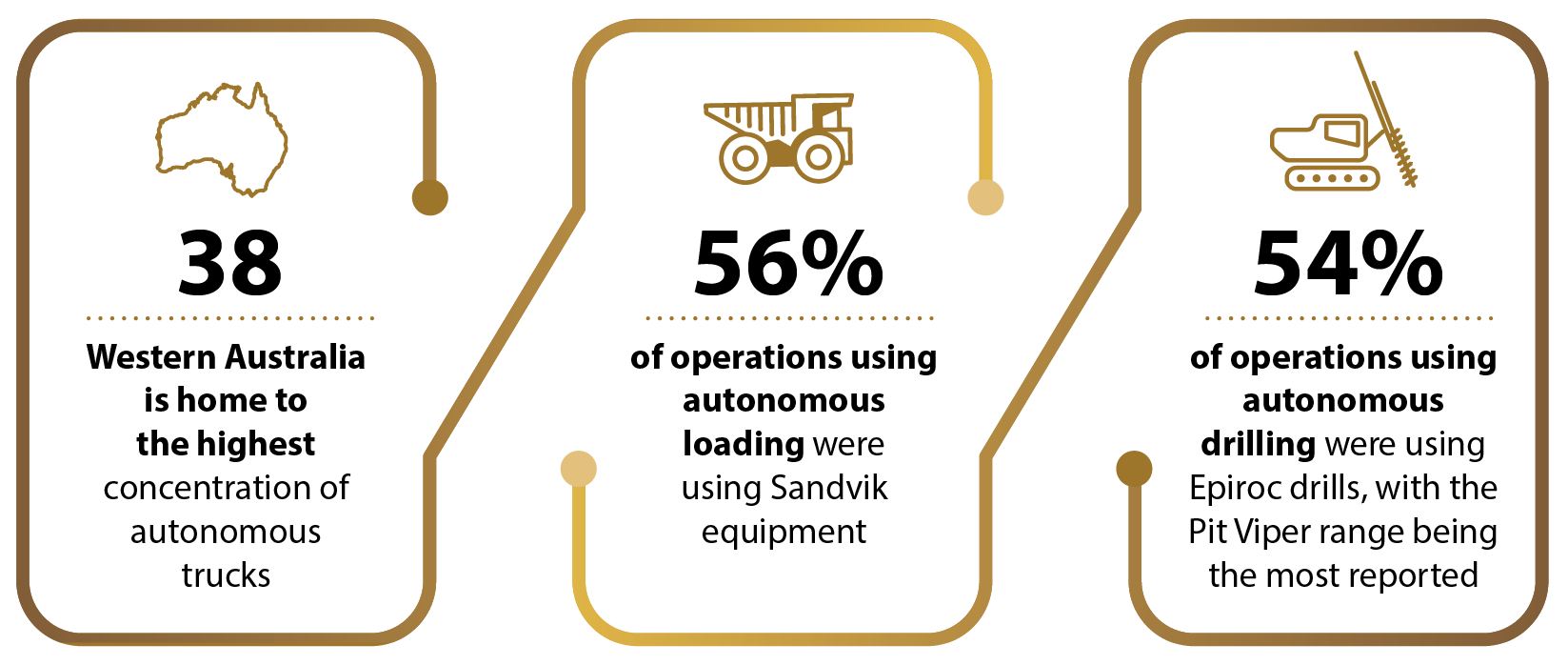

The dominance of certain original equipment manufacturers (OEM) in the field continued: Caterpillar again led in deployments of trucks, with 34% of the market share, while Sandvik dominated the loader field with over 50% of deployments. Finally, Epiroc led the drill race with a presence in 53% of projects.

Despite the slowing pace of adoption, many miners pointed to cost optimisation and efficiency gains achieved consistently by those equipment models.

Mining Magazine Premium Subscribers can read the full report online.

If you'd like to subscribe or upgrade to a Premium Subscription, click here or contact the team at subscriptions@aspermont.com or on +44 (0) 208 187 2299.

Copyright © 2000-2023 Aspermont Media Ltd. All rights reserved. Aspermont Media is a company registered in England and Wales. Company No. 08096447. VAT No. 136738101. Aspermont Media, WeWork, 1 Poultry, London, England, EC2R 8EJ.